What if you could measure your entire semester's academic effort with a single number? Not a grade, not a percentage, but something more honest—a running total that rises when you exceed your goals and falls when you fall short. Something that remembers your best days and your worst, rewarding consistency while forgiving the occasional stumble.

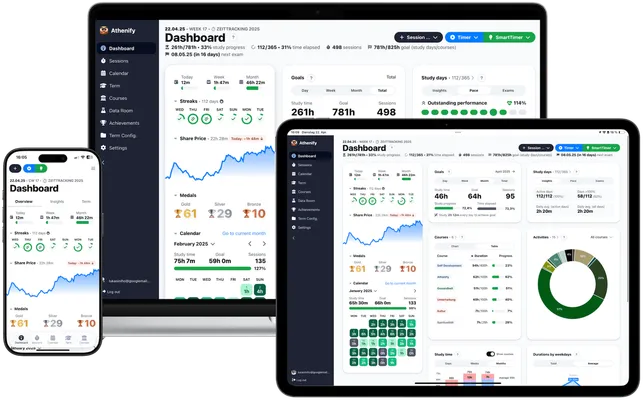

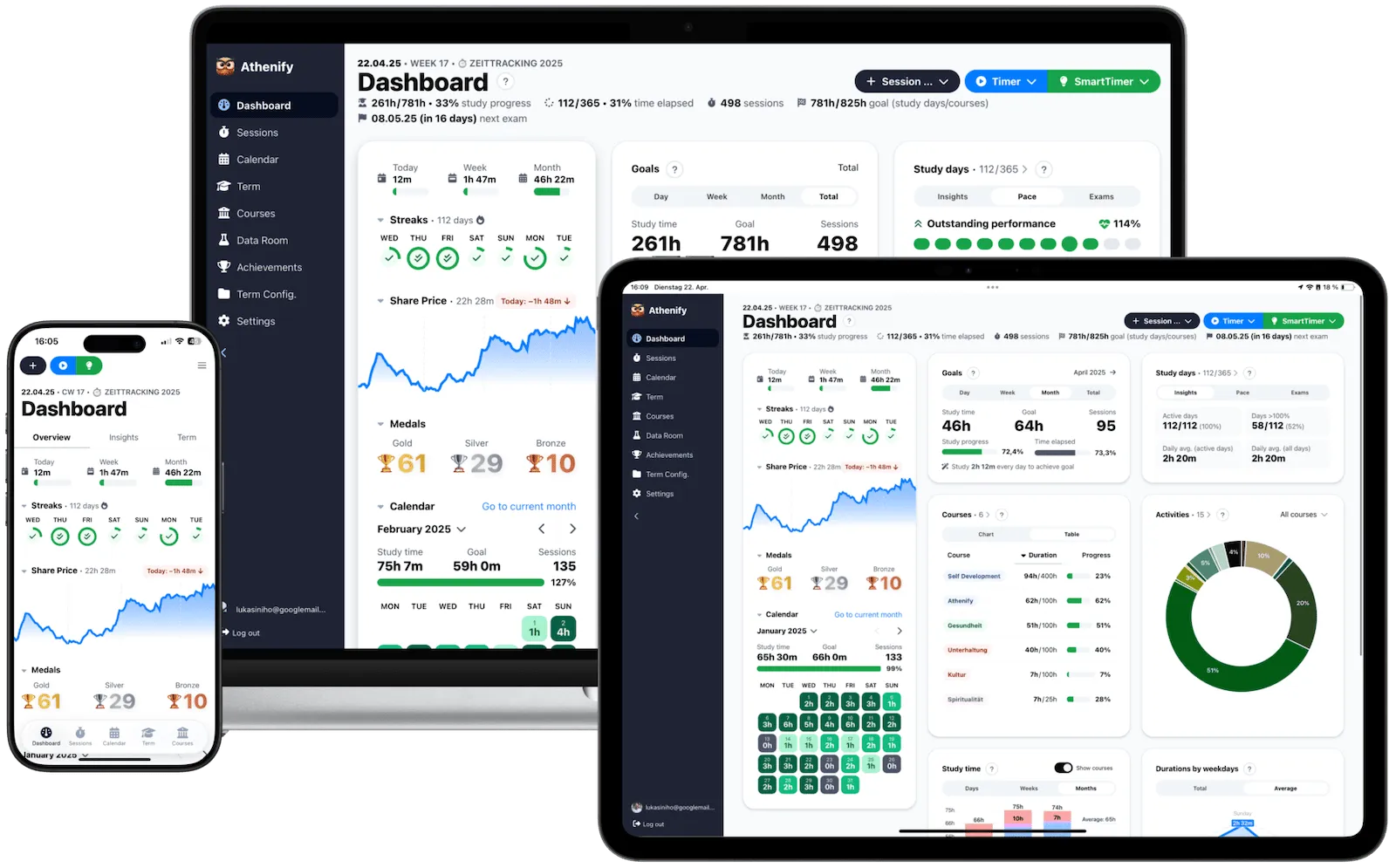

In the predecessor to Athenify—the Study Journal—I created exactly this: the share price. Unlike typical productivity metrics that reset daily or weekly, the share price provides a continuous, cumulative measure of your academic effort that spans your entire semester. It's a single honest number that tells you whether you're ahead of where you planned to be—or behind.

Naturally, Athenify also features the share price. In this article, learn how you can use this innovative feature to stay consistently motivated—and why thinking of your studies like a stock portfolio might be the mindset shift you need.

The concept: going public

When a company goes public (IPOInitial Public Offering), banks help set an initial price for a portion of the company. Over time, the price rises or falls depending on how market participants assess the company's future success. Strong quarterly earnings push the price up; missed targets drag it down. The stock price becomes a single number that captures the market's collective judgment of the company's performance.

In Athenify, your share price works the same way—except you're the company, and study time is your earnings report. Your share price starts at 0 at the beginning of each semester, and your goal is to keep raising it through consistent effort.

Think of yourself as a publicly traded company. Every day, you either beat expectations (exceeding your study goal), meet expectations (hitting your target exactly), or disappoint (falling short). The share price reflects not just today's performance, but your cumulative track record across the entire semester. It's a single, honest number that tells you whether you're ahead of where you planned to be—or behind.

How does the share price work?

The mechanics are straightforward, which is part of what makes this system so effective—there's no ambiguity, no room for self-deception.

Your personal share price starts at zero at the beginning of your semester. In Athenify, you define a daily study goal for each day of the semester (e.g., 180 minutes or 3 hours). This goal represents your benchmark—what you've committed to achieving on an average day.

Each day, one of three things happens:

- Hit your goal exactly – Your share price remains unchanged. The price only reacts to deviations from your target.

- Exceed your goal – Your share price rises by the difference. Study 200 minutes against a 180-minute goal, and your price climbs by 20.

- Fall short – Your share price drops by the difference. Study 100 minutes against a 180-minute goal, and your price falls by 80.

There's no ambiguity, no room for self-deception. The share price simply records the truth of your effort.

What your share price tells you

The share price distills your entire semester's effort into a single, meaningful number. It shows how much more (positive price) or how much less (negative price) you have studied compared to your goals over the entire period.

A positive share price means you're ahead of your targets overall—you've accumulated a buffer of extra study time that gives you flexibility and peace of mind. A negative share price means you've fallen behind on your cumulative goals, and you'll need to put in extra effort to get back on track. And zero means you're exactly where you planned to be—no surplus, no deficit.

This cumulative perspective is what makes the share price so valuable. Unlike daily metrics that reset at midnight, the share price carries forward. A great Monday doesn't disappear on Tuesday; it becomes part of your growing buffer. Similarly, a bad Wednesday doesn't vanish—it shows up in the numbers, motivating you to make up for it.

The reality: ups and downs

Throughout the semester, your share price will rise and fall on different days. This is completely normal—and actually healthy. It's rarely possible to exceed your study goal every single day. Life happens: you get sick, social commitments arise, some days you simply don't have the energy for an exceptional performance.

But that's not a problem, and this is where the stock market metaphor really shines. Just as real investors don't panic over daily fluctuations, you shouldn't stress about individual down days. What matters is the long-term trend. When you exceed your goal on good days—when you have energy and motivation in abundance—it positively affects your share price and builds a buffer. When tougher days come, that buffer absorbs the impact.

Think of it like a real stock: daily fluctuations are normal, but the long-term trend is what matters.

The share price thus always shows whether you are overall above or below your target study time. One bad day among many good ones barely registers. One exceptional day can offset multiple mediocre ones. Zoom out, and what you'll see is the trajectory of your semester-long effort.

Why the share price keeps you motivated

The share price keeps your motivation high throughout the entire semester because it works with human psychology rather than against it.

Three psychological advantages of the share price:

- Recovery mindset – A falling price motivates comeback, not defeat

- Buffer building – Surplus from good days gives flexibility for rest

- Long-term thinking – Encourages viewing the semester as a whole

When your share price falls after a bad day, something interesting happens psychologically. Rather than feeling defeated (as you might with a broken streak or missed daily target), you feel energized to recover. The share price doesn't judge—it simply records. And because it's cumulative, you know that tomorrow's extra effort will directly compensate for today's shortfall. This recovery mindset—backed by the science of study time tracking—is far more sustainable than the all-or-nothing approach that derails so many students. A falling share price doesn't mean failure; it means opportunity.

A falling share price doesn't mean failure—it means opportunity to recover.

If you consistently exceed your goals during high-energy periods—the start of the semester, weekends when you have more time, or those rare days when motivation is abundant—your share price will climb. This growing buffer is like money in the bank. It gives you the confidence to take your foot off the gas when you genuinely need rest, knowing that your accumulated surplus can absorb a few lighter days. This flexibility prevents the burnout that comes from treating every single day as make-or-break.

Unlike daily metrics that reset at midnight, the share price encourages you to think about your semester as a whole. This longer time horizon is psychologically healthier and more aligned with how academic success actually works. One bad day doesn't ruin everything—it's a small blip in a months-long trajectory. Consistent effort over time is what counts, and the share price makes that truth visible and tangible. Building this kind of consistency is one of the best study habits you can develop.

Setting the right daily goals

The share price as a motivational tool only works if you set your daily study goals wisely. This calibration is crucial—get it wrong, and the entire system breaks down. Get it right, and the share price becomes a powerful engine of consistent progress.

If you set your daily goals too low, the share price will rise easily—almost trivially. You'll hit your targets without breaking a sweat, and the share price will climb steadily upward. This might feel good in the moment, but there's a catch: you might end up studying too little overall, even as your share price suggests you're crushing it. The metric becomes artificially inflated and loses its meaning. A share price of +500 minutes means nothing if your goals were set so low that anyone could achieve them.

The opposite problem is equally dangerous. If you set your daily goals too high—perhaps out of ambition or guilt about past procrastination—it will be nearly impossible to raise the share price.

Warning signs your goals are too high:

- Day after day, you fall short despite genuine effort

- The number sinks further into negative territory

- You feel like no amount of work can dig you out

- The temptation to abandon the system grows stronger

Instead of motivating you to work harder, a consistently falling share price breeds discouragement and learned helplessness.

The key is to find the Goldilocks zone—goals that are challenging but not overwhelming. You'll know you've found the right level when:

- Meeting 100% of your goal feels like a genuine accomplishment

- Exceeding your goal on good days feels rewarding and satisfying

- Missing your goal occasionally doesn't feel catastrophic but creates healthy motivation to bounce back

A good rule of thumb: set your daily goal to about 60–70% of what you could achieve on your absolute best day. This leaves room to exceed your target regularly while ensuring the goal remains reachable even on difficult days. When these conditions are met, the share price becomes what it's meant to be: a fair, honest, and motivating measure of your academic effort.

Combining with other motivation features

The share price doesn't exist in isolation—it works best alongside Athenify's other motivation features, each addressing different psychological needs.

Medals reward daily intensity. High-effort days earn Bronze, Silver, or Gold recognition, and those same high-effort days naturally boost your share price too. The medals provide immediate gratification; the share price provides cumulative validation. Streaks encourage consistency—while the share price measures cumulative effort, streaks measure consecutive days of showing up. You can have a healthy share price with sporadic marathon sessions, but building a streak requires daily commitment. Together, these features push you toward both quantity and consistency.

Analytics reveal patterns in your data. Use the dashboard to see how your share price correlates with your productivity patterns—which days of the week you tend to exceed goals, which times of day you're most effective, which subjects get the most attention. This data helps you optimize your schedule to maximize share price growth. For more on building systems that keep you on track, see our guide on how to stay accountable to study goals.

Together, these features create a comprehensive system that keeps you engaged throughout the semester. The share price provides the long-term perspective; medals and streaks provide daily motivation; analytics provide the insights to improve.

Start tracking your share price

The share price transforms abstract study effort into something concrete, visible, and motivating. It provides the long-term perspective that most productivity tools lack, while acknowledging the reality that not every day can be your best.

Try Athenify for free

See your cumulative study effort visualized as a rising share price. Exceed your goals, watch it climb. Building your portfolio of academic achievement.

No credit card required.

No credit card required.