Every year, over 300,000 candidates sit for the CFAChartered Financial Analyst exams—and more than half of them fail. The difference between those who earn the charter and those who don't rarely comes down to intelligence. It comes down to preparation, discipline, and time management. If you're willing to commit 300+ hours per level and track every session honestly, you can join the ranks of the 200,000+ charterholders who've proven the exams are conquerable.

The CFA designation is the gold standard in investment management. Unlike an MBAMaster of Business Administration, which provides broad business education, the CFA designation demonstrates deep, specialized knowledge in investment analysis, portfolio management, and ethical practice.

Here's the reality: The CFA Program is notoriously difficult. Across all three levels, fewer than 20% of candidates who begin Level I ultimately earn the charter. Pass rates hover around 40–50% per level, and the curriculum spans over 3,000 pages of dense material.

Candidates who invest 300+ hours of strategic, tracked study time per level consistently outperform those who "wing it."

The good news? The CFA exams don't test genius—they test preparation. The curriculum is vast but learnable. The questions are challenging but follow patterns. And the charterholders who succeed have one thing in common: they put in the hours, tracked them honestly, and stayed consistent.

This guide will show you exactly how to prepare for the CFA exams using evidence-based study strategies, optimal time allocation, and systematic progress tracking. For a broader overview of exam preparation timelines, see our guide on How Long Should You Study for an Exam? You may also find our comprehensive exam preparation guide helpful for understanding the fundamentals of high-stakes professional certification exams.

Understanding the CFA program: format and structure

The three levels

| Level | Format | Questions | Duration | Focus |

|---|---|---|---|---|

| Level I | Multiple Choice | 180 questions (2 sessions) | 4.5 hours | Knowledge and comprehension |

| Level II | Item Sets (Vignettes) | 88 questions (22 item sets) | 4.5 hours | Application and analysis |

| Level III | Constructed Response + Item Sets | Essay + 44 item set questions | 4.5 hours | Synthesis and portfolio management |

CFA exam pass rates

| Level | Recent Pass Rate | What It Means |

|---|---|---|

| Level I | ~42% | More than half fail—preparation is critical |

| Level II | ~45% | Item set format catches many off guard |

| Level III | ~53% | Highest pass rate, but still demanding |

What each level tests

Level I: Investment Tools covers breadth over depth across all 10 topics. It tests knowledge and comprehension using a multiple choice format with three answer choices. This level builds the foundation for Levels II and III.

Level II: Asset Valuation emphasizes depth over breadth—same topics, but harder application. The item set format presents a vignette followed by 4 questions per mini-case, testing your ability to analyze complex scenarios with heavy emphasis on valuation models.

Level III: Portfolio Management requires integration and synthesis. The morning session features constructed response (essay) questions, while the afternoon uses item sets. The focus shifts to portfolio construction, wealth planning, and institutional investing.

The 10 CFA topic areas

The CFA curriculum covers 10 topic areas with varying weights by level:

| Topic Area | Level I Weight | Level II Weight | Level III Weight |

|---|---|---|---|

| Ethical and Professional Standards | 15–20% | 10–15% | 10–15% |

| Quantitative Methods | 6–9% | 5–10% | 0% |

| Economics | 6–9% | 5–10% | 5–10% |

| Financial Statement Analysis | 11–14% | 10–15% | 0% |

| Corporate Issuers | 6–9% | 5–10% | 0% |

| Equity Investments | 11–14% | 10–15% | 10–15% |

| Fixed Income | 11–14% | 10–15% | 15–20% |

| Derivatives | 5–8% | 5–10% | 5–10% |

| Alternative Investments | 7–10% | 5–10% | 5–10% |

| Portfolio Management | 8–12% | 10–15% | 35–40% |

Ethics appears at every level—and matters for borderline scores. Portfolio Management dominates Level III at 35–40%, becoming essentially the focus of the entire exam. Financial Statement Analysis is critical for Levels I and II but drops as a standalone topic at Level III, along with Quantitative Methods. Understanding these weight shifts helps you prioritize your study time as you progress through the program.

How many hours should you study for the CFA?

The CFA Institute surveys candidates after each exam, and the data is clear about what it takes to pass.

The research-backed hour requirements

CFA Institute survey data reveals the average reported preparation time across levels: 303 hours for Level I, 328 hours for Level II, and 344 hours for Level III. That's approximately 975 hours total across the program—the equivalent of six months of full-time work dedicated solely to exam preparation.

Factors that affect your study time

Your background significantly influences how many hours you'll need:

- Finance/CFA background – 250–300 hours may be sufficient if you have a finance undergraduate degree.

- Related fields – Accounting or economics backgrounds typically need 300–350 hours.

- Career changers – Non-finance backgrounds (engineering, liberal arts) should plan for 350–400+ hours.

- Investment management experience – Makes content familiar and accelerates learning.

- Unrelated work experience – Requires extra time to contextualize concepts you're not applying daily.

- Recent graduates – Study habits are intact; typically progress faster.

- 5+ years out of school – May need extra time to rebuild study discipline.

One hour of timed, focused practice is worth 2–3 hours of casual "studying" with distractions.

Perhaps most critically, study efficiency determines whether your logged hours translate to actual learning. Tracked, focused study sessions require the base recommended hours, but untracked, distracted studying demands 30–50% more time to achieve the same results. This is why time tracking with Athenify is crucial—it enforces honest accounting of actual focused work. For a deeper exploration of optimal daily study volume, see our guide on how many hours you should study per day.

Creating your CFA study timeline

Most successful CFA candidates study 5–6 months per level. The timeline you choose should match your background, work demands, and learning style.

The 4-month intensive plan targets 300–350 hours at 18–22 hours per week. This approach works best for full-time students or those with strong finance backgrounds, but the high intensity leaves little buffer for setbacks. Miss a week due to work demands or illness, and you're suddenly scrambling.

The 5-month balanced plan aims for 320–380 hours at 15–18 hours per week. This is the most popular timeline for good reason—it's sustainable for working professionals while still maintaining momentum. If you have some finance background and can commit to roughly 2 hours on weekdays plus 5 hours on weekends, this is likely your sweet spot. For strategies on building and maintaining this kind of consistent schedule, see our guide on creating an effective study schedule.

The 6-month extended plan spreads 350–420 hours across 12–16 hours weekly. Career changers, those with demanding jobs, or candidates from non-finance backgrounds should consider this more gradual approach. The sustainable pace allows more time to truly absorb difficult topics rather than rushing through them.

The proven CFA study plan: 5-month timeline (Level I)

Let's detail a 5-month (22-week) study plan targeting 340 hours for Level I. This timeline breaks into four distinct phases, each with specific goals and time allocations.

Phase 1: Content review (Weeks 1–12)

The first phase builds your comprehensive foundation across all 10 topics. Plan for 14–16 hours per week, totaling 168–192 hours for this phase alone.

| Weeks | Topics | Hours | Activities |

|---|---|---|---|

| 1–2 | Quantitative Methods, Ethics intro | 28–32 | Read curriculum, practice problems, Anki cards with spaced repetition, active recall |

| 3–4 | Economics, Corporate Issuers | 28–32 | Read curriculum, practice problems |

| 5–7 | Financial Statement Analysis | 42–48 | Deep dive—this is critical for Level I |

| 8–9 | Equity Investments | 28–32 | Valuation concepts, industry analysis |

| 10–11 | Fixed Income, Derivatives | 28–32 | Bond math, option strategies |

| 12 | Alternative Investments, Portfolio Mgmt | 14–16 | Round out content, start mock exams |

A typical daily breakdown for 15 hours per week looks like 2 hours on each weekday plus 2.5 hours on each weekend day. Breaking these sessions into focused intervals using the Pomodoro technique can help maintain concentration across months of preparation. This pattern is sustainable alongside a full-time job while still building meaningful momentum.

Phase 2: Practice and application (Weeks 13–17)

With your foundation built, phase two shifts to applying knowledge through practice problems and topic tests. Increase your weekly commitment to 16–18 hours, targeting 80–90 total hours in this phase.

| Week | Focus | Hours | Activities |

|---|---|---|---|

| 13 | Ethics deep dive, topic tests | 16–18 | CFA Institute topic tests, Ethics memorization |

| 14 | Quant/Econ/Corp Issuers review | 16–18 | Weakness drilling, practice problems |

| 15 | FSA and Equity intensive | 16–18 | Heavy practice on highest-weight topics |

| 16 | Fixed Income/Derivatives/Alts | 16–18 | Formula memorization, practice |

| 17 | First full mock exam + review | 16–18 | Complete mock under test conditions |

CFA Institute's own topic tests are the most representative practice available. Complete all of them before moving to third-party materials. Track which topics you're drilling and for how long in Athenify to ensure you're allocating time proportionally to exam weights.

Phase 3: Mock exam intensive (Weeks 18–20)

This is where exam stamina is built. Push to 18–20 hours per week, with 54–60 hours dedicated to mock exams and thorough review.

| Week | Focus | Hours | Activities |

|---|---|---|---|

| 18 | Mock exam #2 + thorough review | 18–20 | Full mock, 4–6 hour review |

| 19 | Targeted drilling, mock exam #3 | 18–20 | Weakness focus, full mock |

| 20 | Mock exam #4, strategy refinement | 18–20 | Final full mock, timing practice |

For every 4.5 hours spent taking a mock exam, spend 4–6 hours reviewing it.

The review ratio is critical: taking the mock requires 4.5 hours, but reviewing every question—understanding why right answers are right and wrong answers are wrong—demands another 4–6 hours. That's 8.5–10.5 hours per mock exam when done properly. Track mock exam scores and review time separately in Athenify.

Phase 4: Final preparation (Weeks 21–22)

The final two weeks are about peaking at the right moment. Plan for just 20–25 hours total—this phase is about maintaining sharpness, not cramming new material.

| Day | Activity | Time |

|---|---|---|

| 14 days out | Light review of weakest topics | 2–3 hours |

| 13–11 days out | Formula review, Ethics drilling | 4–6 hours |

| 10–8 days out | One timed topic test per day (weak areas) | 3–4 hours |

| 7 days out | Light mock exam (half-length) or topic tests | 2–3 hours |

| 6–4 days out | Review notes, formulas, Ethics standards | 3–4 hours |

| 3 days out | Complete rest day | 0 hours |

| 2 days out | Quick formula review, skim Ethics | 1–2 hours |

| 1 day out | Prepare materials, early bed | 0 hours |

Topic-specific strategies

Ethics and professional standards

Ethics carries 15–20% weight at Level I and 10–15% at Levels II and III—but its importance extends beyond the point allocation. The CFA Institute explicitly considers Ethics performance for candidates near the passing threshold, meaning a strong Ethics score can push you from fail to pass.

Ethics is unique in that it combines memorization of the Standards of Professional Conduct with judgment calls on applying those standards to complex scenarios. Many candidates underestimate it because it seems "soft" compared to the quantitative sections. This is a costly mistake.

Your study approach should follow these steps:

- Read the Standards three times – Memorize the structure: 7 Standards with multiple sub-standards under each.

- Shift to scenario practice – The exam tests application rather than mere recall.

- Complete all CFA Institute Ethics problems – They're the most representative of actual exam questions.

- Review Ethics during your final week – Fresh recall matters most for this topic.

Watch for common Ethics traps: confusing "should" versus "must," overlooking mosaic theory exceptions, misapplying soft dollar standards, and forgetting priority of transactions rules.

Financial statement analysis (Level I & II)

FSA Financial Statement AnalysisThe key areas span the full range of financial reporting:

- Income statement analysis – Revenue recognition and expense matching

- Balance sheet analysis – Assets, liabilities, and equity

- Cash flow statement – Operating, investing, and financing activities

- Financial ratios – Profitability, liquidity, solvency, and activity

- Intercorporate investments – Equity method and consolidation

- Inventory accounting – FIFO, LIFO, weighted average

- Long-lived assets – Depreciation and impairment

- Income taxes – Deferred tax assets and liabilities

High-yield formulas to master include DuPont analysis for ROEReturn on Equity decomposition, current and quick ratios for liquidity, debt-to-equity and interest coverage for solvency, and inventory turnover and days sales outstanding for efficiency.

Equity investments

Equity carries 11–14% weight at Level I and 10–15% at both Levels II and III. The core skill is valuation—master the models, and you'll handle most questions.

Level I builds foundational knowledge: market organization and structure, security market indices, market efficiency concepts, and basic equity valuation through the DDMDividend Discount Model. Level II dives deep into Dividend Discount Models (Gordon Growth and multi-stage), Free Cash Flow valuation (FCFFFree Cash Flow to the Firm and FCFEFree Cash Flow to Equity), residual income valuation, market-based valuation using multiples, and private company valuation.

Fixed income

Fixed income grows in importance as you advance—from 11–14% at Level I to 10–15% at Level II to 15–20% at Level III, where it becomes a major component of the portfolio management focus.

Master bond pricing and yield measures including YTMYield to Maturity, current yield, and spot rates. Duration and convexity are essential for understanding interest rate sensitivity. Term structure theories explain yield curve shapes. Credit analysis covers credit spreads and default risk. Structured products like MBSMortgage-Backed Securities and ABSAsset-Backed Securities appear prominently at Level II.

Common mistakes include confusing Macaulay and modified duration, misunderstanding which direction the convexity adjustment moves prices, and forgetting that bond prices and yields move inversely.

Portfolio management

Portfolio Management starts small at 8–12% of Level I but grows to 10–15% at Level II before dominating Level III at 35–40%. Level III is essentially a portfolio management exam with ethics woven throughout.

Level I establishes the basics: portfolio risk and return concepts, the CAPMCapital Asset Pricing Model, Modern Portfolio Theory, and the efficient frontier. Level III demands mastery of IPSInvestment Policy Statement construction, asset allocation strategies, equity and fixed income portfolio management techniques, risk management frameworks, wealth planning for individuals, and institutional portfolio management for pensions, endowments, and foundations.

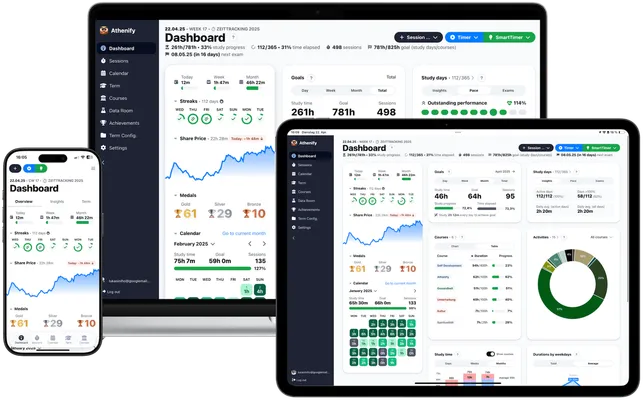

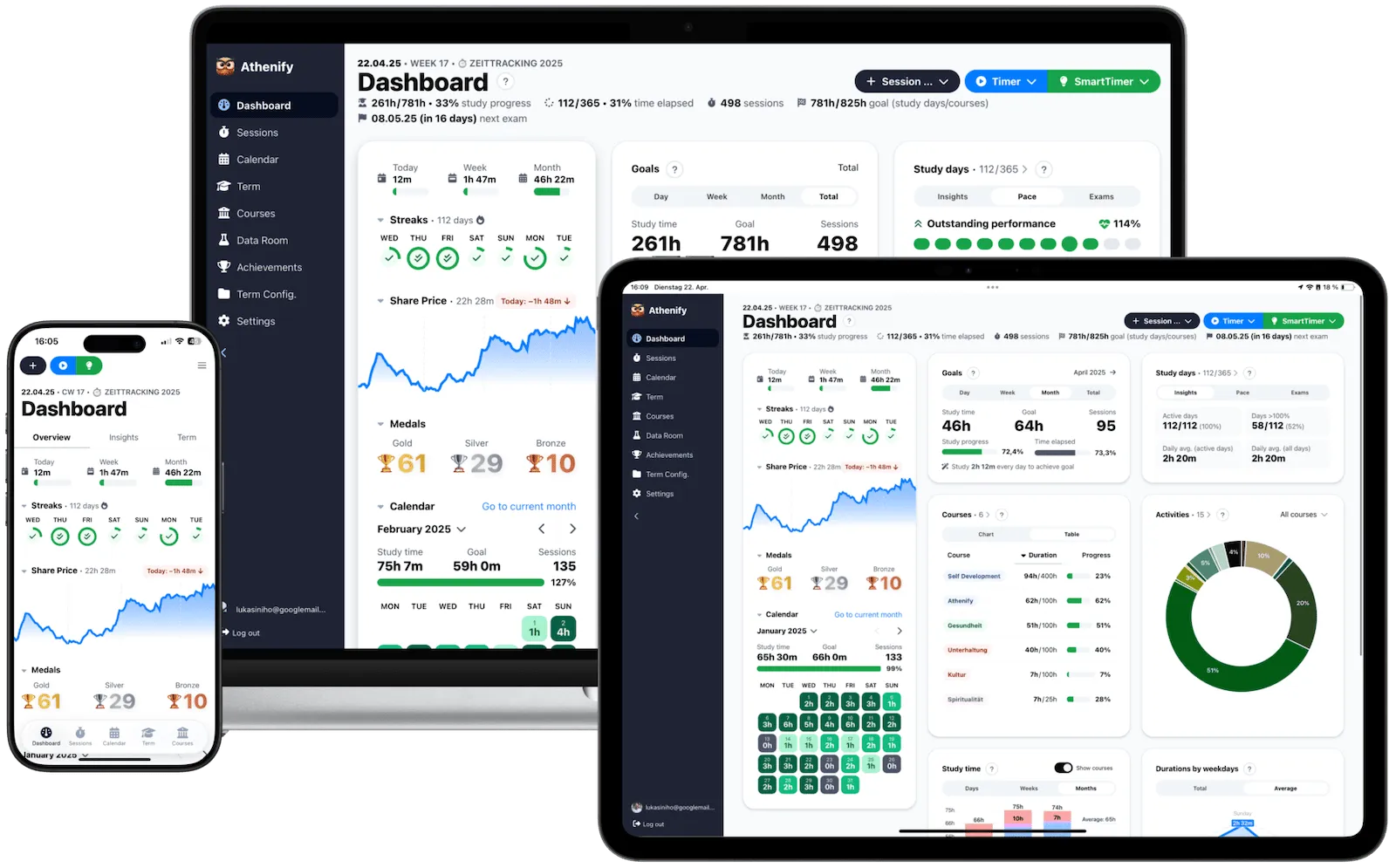

How Athenify optimizes your CFA preparation

The CFA Program requires 900+ hours across three levels. Without tracking, candidates consistently make the same mistakes:

- Overestimate study time – By 30–50%, believing they've worked more than they have

- Neglect difficult topics – Gravitating toward comfortable subjects instead

- Lose visibility – Unable to identify which methods are actually working

- Lose motivation – The long journey wears down commitment without visible progress

Athenify solves these problems with purpose-built tracking for exam preparation.

Topic-based time tracking

Create categories for each CFA topic area: Ethics and Professional Standards, Quantitative Methods, Economics, Financial Statement Analysis, Corporate Issuers, Equity Investments, Fixed Income, Derivatives, Alternative Investments, Portfolio Management, Mock Exams, and Mock Exam Review.

After 3–4 weeks of tracking, you'll see your actual time distribution. Most candidates discover they're over-investing in comfortable topics and neglecting weak areas. If you're spending 20% of time on Ethics because you enjoy the scenarios but only 8% on Fixed Income because bond math is hard, Athenify makes this imbalance visible—and correctable.

Hour goals and progress tracking

Set phase-specific goals aligned with the study plan: 168–192 hours for Phase 1 content review, 80–90 hours for Phase 2 practice, 54–60 hours for Phase 3 mock exams, and 20–25 hours for Phase 4 final prep, totaling 322–367 hours.

Athenify tracks your progress toward these milestones in real-time. If you're behind pace in Week 8, you know immediately and can adjust in Week 9 rather than discovering the gap too late.

Mock exam score tracking

Log every mock exam with the exam number, date taken, score (overall plus topic breakdown), hours studied since the last mock, key weaknesses identified, and review time spent.

After 3–4 mocks, patterns emerge clearly: your overall score trajectory shows whether you're approaching the passing threshold, topic-specific trends reveal if Fixed Income is improving while Ethics stagnates, and score variance indicates whether inconsistent fundamentals need attention.

Try Athenify for free

Track your 300+ hours of CFA prep per level, see which topics need more time, and stay on pace through months of preparation.

No credit card required.

No credit card required.

Gamification for long-term consistency

Studying for 5–6 months per level is a marathon, not a sprint. Athenify's gamification features help maintain motivation when the finish line feels far away.

Streaks reward consistent daily effort—study at least 2 hours daily and build a 60-day streak leading into your exam. Breaking a long streak hurts, which keeps you showing up on days when motivation is low. Medals at bronze, silver, and gold levels reward meeting, exceeding, and doubling your daily goals. Your Share Price visualizes cumulative effort as a rising number, letting you watch it climb from 0 to 300+ hours.

Candidates who maintain consistent study streaks—even just 2 hours per day—outperform those with sporadic patterns, even when total hours are similar. Consistency beats intensity for CFA success.

Common CFA preparation mistakes

Even dedicated candidates make preventable errors. Here are the five most common—and how to avoid them.

Mistake #1: Underestimating the time commitment

"I'll study for 8 weeks—I work in finance, so I know this stuff."

Many finance professionals fail Level I because they underestimate the curriculum's breadth. Working in finance doesn't mean you've studied all 10 topics systematically. You might know equity valuation cold but have never touched derivatives or alternative investments.

Solution: Commit to 300+ hours over 5–6 months regardless of background. Use Athenify to track from Day 1.

Mistake #2: Neglecting ethics

"Ethics is common sense. I'll skim it the week before."

Ethics is 15–20% of Level I and can determine borderline outcomes. It requires memorization of specific standards and application to complex scenarios that often have counterintuitive correct answers.

Solution: Allocate 15% of study time to Ethics. Track it separately in Athenify. Review Ethics during your final week.

Mistake #3: Using only third-party materials

Schweser, Kaplan, and other prep providers are helpful—but they're summaries. The CFA Institute curriculum contains nuances and phrasing that appear on the actual exam.

Solution: Use third-party materials for efficiency, but read the actual CFA Institute curriculum for at least Ethics, FSA, and your weakest topics. Complete all CFA Institute topic tests and mock exams.

Mistake #4: Passive studying

Reading the curriculum, watching videos, and highlighting text all feel like studying—but they're not. Active practice through solving problems, completing topic tests, and taking mocks is what actually builds exam-ready knowledge.

Solution: Track "reading" versus "practice" time separately in Athenify. Ensure 60%+ of your hours are active practice, especially in Phase 2 and beyond.

Mistake #5: Ignoring the CBT format

Since 2021, all CFA exams are computer-based. The interface, navigation, and timing feel different from paper-based practice. Candidates who prepare only with paper materials often lose precious time navigating the unfamiliar system.

Solution: Take at least 2–3 practice exams using the CFA Institute's online practice platform. Get comfortable with the calculator (Texas Instruments BA II Plus or HP 12C), flagging questions, and navigating the interface.

The final week: taper and confidence

Your brain needs rest to perform optimally. Students who cram the final 48 hours typically score 3–5% lower than those who taper properly. Trust your 300+ hours.

| Day | Activity | Time |

|---|---|---|

| 7 days out | Light topic review (weakest areas) | 2–3 hours |

| 6 days out | Ethics Standards review | 2 hours |

| 5 days out | Formula sheet review, key ratios | 1.5 hours |

| 4 days out | One timed topic test (random mix) | 1 hour |

| 3 days out | Complete rest day | 0 hours |

| 2 days out | Quick Ethics and formula skim | 1 hour |

| 1 day out | Prepare materials, rest, early bed | 0 hours |

Exam day strategy

The night before

Prepare everything: admission ticket (printed), passport or government ID, approved calculator with fresh batteries, and earplugs if you're noise-sensitive. Aim for 8 hours of sleep. Do no CFA studying—your brain needs rest. Lay out your clothes and materials so the morning is stress-free.

The morning of

Eat a high-protein breakfast like eggs or Greek yogurt to avoid a sugar crash mid-exam. Arrive 30–45 minutes early to account for check-in procedures. Bring water and a light snack for the break. Visit the bathroom before check-in, and use deep breathing to manage nerves while you wait.

During the exam

Session 1 (Morning) presents 90 questions in 2 hours 15 minutes. Maintain a pace of roughly 1.5 minutes per question. Flag difficult questions and return to them rather than getting stuck. Never spend more than 3 minutes on any single question.

Break lasts 30 minutes and is optional but recommended. Eat your snack, hydrate, walk around, and stretch. Don't review notes—it's against testing rules.

Session 2 (Afternoon) mirrors the morning with 90 questions in 2 hours 15 minutes. Approach it as a fresh start—don't dwell on the morning session. Use the same pacing strategy, and remember to answer every question since there's no penalty for guessing.

Retake strategy

About 55–60% of CFA candidates fail each level. If you're among them, you're in good company—and you can succeed on your next attempt. Most charterholders failed at least one level. Persistence is part of the CFA journey.

When to retake

Consider a retake if you were close to passing based on your topic-level results, if your weak topics are clearly identified through the CFA Institute's feedback, and if you're committed to adding 80–120 hours of additional study. Most importantly, address what went wrong—whether that was study method, total time, or focus areas.

Retake study plan (3–4 months)

The retake timeline compresses because you're building on existing knowledge. Month 1 should focus 80% of time on your 2–3 weakest topics identified in your results. Month 2 shifts to balanced review with heavy practice problems. Month 3 is mock exam intensive—take 3–4 full mocks with thorough review. If you have a fourth month, use it for light taper and confidence building.

Your knowledge hasn't disappeared—you're building on a foundation. Focus on weak areas, not comfortable topics. Track retake hours separately in Athenify to ensure you're putting in the necessary additional work. Complete all CFA Institute topic tests and mocks you haven't already done.

Conclusion: from candidate to charterholder

The CFA Program is demanding—but achievable. Hundreds of thousands of professionals have earned the charter before you. They weren't all geniuses. They were prepared, consistent, and committed.

The CFA charter is earned one hour at a time. Track them, and you'll earn it.

The formula is proven. Commit adequate time—300+ hours per level over 5–6 months. Track every session using Athenify to log all study time by topic. Master Ethics because it's weighted heavily and affects borderline scores. Practice actively, ensuring 60%+ of time is spent doing problems rather than just reading. Take official mocks since CFA Institute materials are most representative. Analyze your data to identify weak topics and rebalance. Stay consistent—daily study beats weekend cramming.

Set up your Athenify categories for all 10 CFA topics. Set your total hour goal (300+ per level). Log your first study session. Watch your hours accumulate and your mock scores rise.

The candidates who earn the CFA charter aren't necessarily the most naturally gifted in finance. They're the ones who showed up every day, tracked their progress honestly, and trusted the process—even when improvement felt slow.

You can be one of them.